SMALL BUSINESS HEALTH CHECK

Get matched instantly

Compare your matches and get the funding your business needs.

Totally free process and will not affect your credit rating

Instant Results

See how much you can borrow and with which lender, instantly

Up to $500k

For business loans, you could qualify to borrow up to $500,000

190+ Products

We offer over 190 products from more than 70 different lenders

Why business health matters

Knowing your business health puts you in a better position when dealing with lenders, suppliers, and customers. If your small business is in good shape (financially), it’s easier to attract finance and new commercial relationships.

Here’s why it matters:

- New customers, suppliers, potential business partners, and lenders often check your business health before engaging with you.

- Lenders want reassurance that lending to you is low risk.

- Good business health shows you’re heading in the right direction and primed for long-term growth.

3 ways to check your small business health

1. Conduct a SWOT analysis

Every business should conduct a SWOT analysis to understand its strengths, weaknesses, opportunities and threats. It can be a structured or informal assessment. The main goal is to recognise how to best leverage advantages and identify areas for improvement.

A SWOT analysis can then provide a strategic framework to set realistic goals for your business, resource allocation, and risk management.

2. Get a certificate of good standing

A certificate of good standing is a document that proves your business is properly registered in Australia and valid. It will also show your business is not in liquidation, receivership or administration or being investigated by the Australian Securities and Investments Commission (ASIC).

To acquire a certificate of good standing, you’ll need to engage a Notary Public, who will check all this information through the ASIC companies and organisations register and issue the certificate.

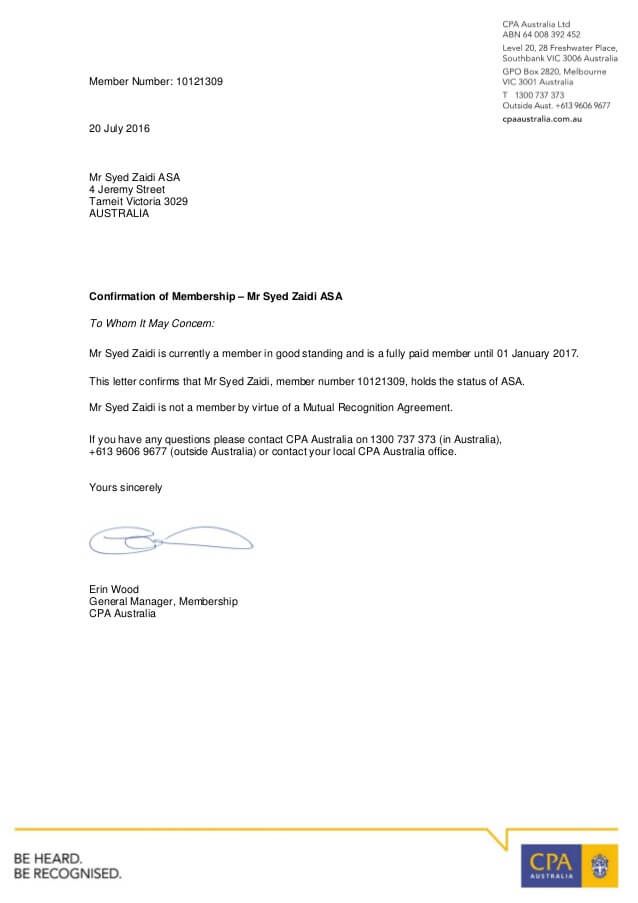

Example certificate of good standing from CPA Australia

A certificate of good standing is usually required if you or any company directors want to do business or invest overseas. But, if you’re a small domestic business, chances are that you’ll never need a certificate of good standing. For you, ‘good standing’ is more likely to refer to your business reputation and financial stability and more specifically your credit rating.

If you’re thinking of taking out a business loan, your financial good standing will have a big impact on whether or not you can access credit — and if so, how much you will be charged for your finance.

3. Check your credit score

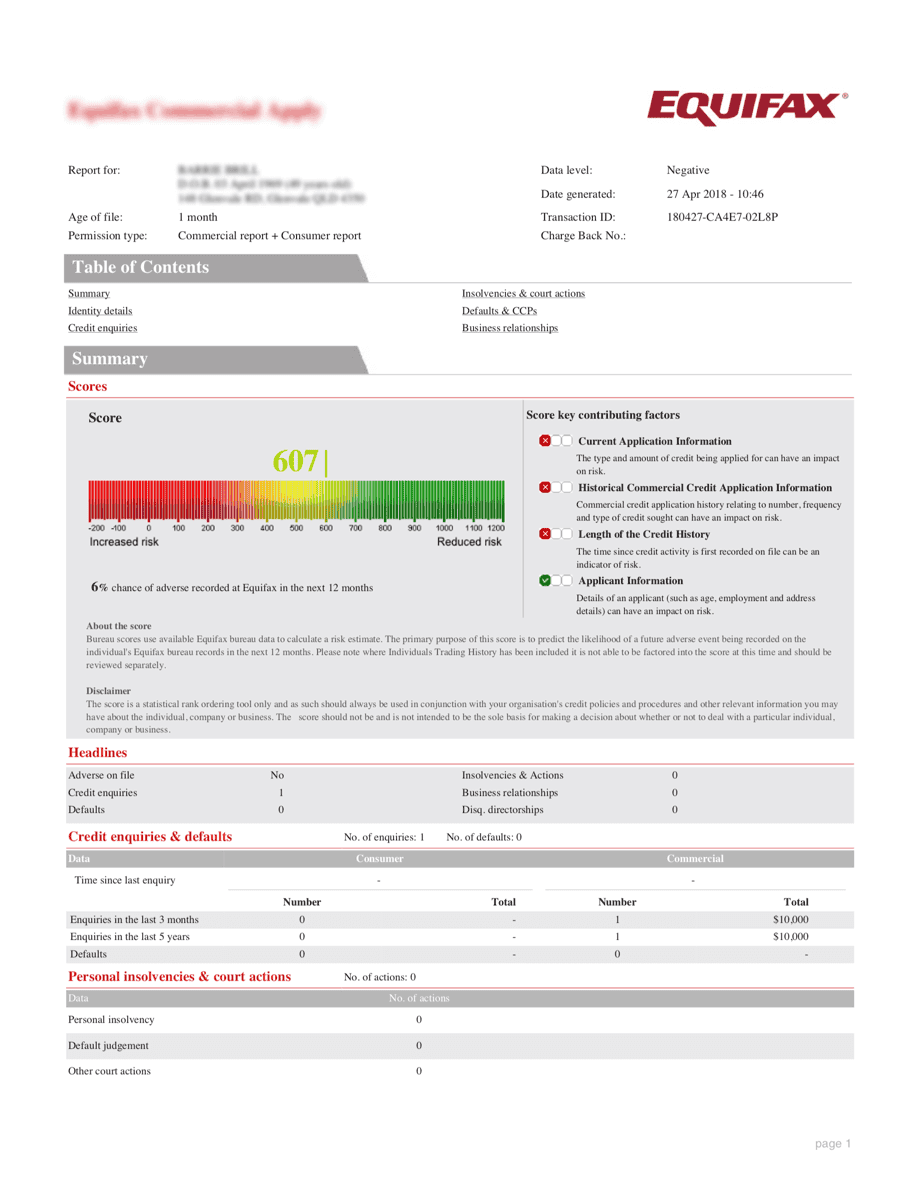

Periodically check your business credit score or request a copy from one of Australia’s credit bureaus, such as Equifax or illion. Your credit score will put you into an assessment band, from ‘excellent’ down to ‘below average’. The minimum credit score for business lending is around 400.

Example credit report from Equifax

Lenders may also want to look at your financial good standing as a business owner — your personal credit rating and that of any company directors (if a company).

For some types of business finance (especially unsecured business loans), you may be asked to provide a personal guarantee of the loan, in which case your personal credit score will of course be critical.

If you’re newly starting out in business, or if your business has not yet made any transactions on credit, it may not have an active credit file and rating.

Get a business loan quote (no credit score impact)

See if you qualifyHow your credit score & business health are assessed

Your credit score is calculated by credit rating bodies (CRBs) in Australia, and each uses a slightly different scoring system. In each case, the higher the score, the better your financial standing is considered to be — and the more likely you are to be able to access finance at reasonable rates.

If your credit score isn’t as high as you’d like, you can order a full report directly from the CRB to understand what’s dragging you down and take steps to fix any issues.

The main credit rating bodies in Australia are:

- illion

- Experian

- Equifax

Example of a scoring system for each credit bureau

Each of these CRBs bases its score on the financial information on your report, which for a business will include:

How long your business has been operating

The number of credit inquiries on your report

Payment patterns on existing loans

Judgments against you, payment defaults, and any other commercial credit information

Information about the owners or directors of your company, including bankruptcies, defaults and court judgments

Any other relevant information about your business on the public record, such as unpaid taxes, recorded liens and lawsuits

How NOT to check your credit score

Don’t apply for a loan in the hope of finding out what your credit score is. Every time a potential lender checks your credit, the mere fact that someone has looked at your file will be marked on your report. Too many entries in a short period of time will drive your score down. What’s more, if you apply for finance and are rejected, you’ll get a negative entry on your credit report, which could do even more harm. This is why it’s important to check your credit rating yourself before you start applying for finance. You can use several free services to take an instant look at your credit score.

Here are the best free credit score providers in Australia

What if your business health isn’t so good?

If your credit report contains any errors (e.g. notations for unpaid bills or late payments) you can take steps to get them removed from your report.

There are several companies out there offering to repair your credit record for a fee, but be cautious about using these services. There’s nothing they can do that you can’t do yourself for free. Check out ASIC's Moneysmart website for tips and strategies to fix your credit history.

Alternatively, seek advice from a professional financial advisor. Over time, you can repair a bad credit rating and get your business into a much stronger financial position to access business finance at a reasonable rate.

Other factors that impact your business health

While your credit rating is an important factor when it comes to getting a business loan, it’s only one of several data points your lender will use to assess your business.

Some lenders, especially traditional banks, will look at the broad 'character' of your business and consider where you stand within the context of your sector.

This means that your trading history, reputation with your customers, competitors and suppliers, your management team's experience and expertise, market share, and the outlook for your industry will all be considered when deciding whether your company is in 'good standing'.

What’s more, your character is just one of the ‘five Cs of business credit’ that your lender will use to evaluate your application. A 1200/1200 credit rating and a first-rate reputation won’t guarantee you finance if you can’t service a loan.

Even if your business is not in good health right now, the sooner you know, the sooner you can do something about it.