If you’re anything like most small business owners, when you think about your accounts it probably goes something like this:

“What a massive hassle. There’s so much to keep track of, so much complicated paperwork –- I’d best leave all that to my accountant (no matter how much they charge me).”

Back in the day, that was probably true. But no more.

These days, you can get easy to use business accounting software, which you can access online from anywhere, from any device.

Track your receipts and payments, automatically have your bank transactions imported, reconcile your bank balance, pay your staff, monitor your cash flow and lodge your BAS, all on your computer, your tablet, or even your smart-phone.

Sounds too good to be true? It really isn’t.

Let me show you.

In this article I’ll give you a handy overview of three of Australia’s most popular small business accounting software packages – with pros and cons and, of course, a heads-up on cost.

But first, there are a few things you need to know.

What you need to think about when choosing your accounting software?

Choose wisely, and your new accounting package will become the backbone of your business – an intuitive, multi-purpose a tool that will let you manage your finances (and lots of other aspects of your business admin) with total ease.

Of course, there’s plenty to think about when it comes to choosing the right software:

“But I’m busy”, you’re probably thinking.

“I don’t have time to do think about all that.”

Don’t worry – that’s exactly what this article is for.

Here you’ll find what you need to know about three of Australia’s most highly-recommended accounting software packages, to help you decide which is right for your small business.

First up, let’s take a look at Xero.

Xero

The basics

Xero was made specifically for business owners rather than professional accountants.

Having said that, they’ve made it easy to give your accountants access, so they can still to help you manage anything you don’t feel confident to handle on your own. (Hello? Tax?)

Xero is highly flexible and suitable for SME’s in a huge range of sectors, including retail, e-Commerce, IT, non-profit, legal, hospitality, healthcare, construction, and many more.

Oh, and if you’re wondering about its credentials, Xero has netted the Canstar Blue award for best small business accounting software for the last four years in a row.

What features does it offer you?

Xero offers a truly impressive list of features:

-

With the invoice feature, you can set up repeating invoices which will be created automatically and sent direct to the recipient’s pre-programmed email address.

You can send bulk invoices, assign specific expenses to customers within an invoice, and add the option to get paid instantly via Stripe, PayPal or Square.

- With another feature you can easily manage your business expenses. Keep track of what bills are due, keep all your expenses organised in one place, and set specific bills on repeat so that you don’t have to keep entering your rent bill - for example - each month.

- Do you deal with clients, customers, or vendors from other countries? No problem, because Xero allows you to set the currency for each contact.

- Payroll couldn’t be easier with Xero’s payroll feature. There are built in time sheets and you can set custom pay rates for individual employees, control the payroll calendar and manage employee leave. With ‘Xero Me’ app for iOS or Android, you can also give your employees limited access to their payroll information.

How easy will you find it to use?

Xero is a very user-friendly package.

You can access it via your PC or Mac, or on any iOS or Android device, which makes it super easy to handle your business on the go. What’s more, you can customise the dashboard based on how you want to use it. For example, you could have ‘Bills to pay’ and ‘Expense claims’ front and centre, so you can easily perform any actions within those categories.

You can connect Xero to a staggering 700+ other smart business apps, making it incredibly easy to integrate with your other systems – which could end up saving you a massive amount of time, money and hassle.

If you ever need help or have any questions, Xero offers free online support, 24/7, so you’ll never be left to figure things out on your own.

How much will it cost you?

Xero works on a monthly subscription basis, with three levels of service to choose from, ‘Starter’, ‘Standard’ and ‘Premium 5’. If you need more features, you can add a range of optional extras to each package it. Here’s a quick overview, or you can visit the site to check out the details. If you want to test the waters, they do offer a free trial.

With all of the features on offer from Xero, it is definitely worth checking out.

Think it looks a little pricey? Don’t need quite so many bells and whistles?

You might want check out our next candidate instead…

Intuit Quickbooks

The basics

Quickbooks is one of the big guns in the business accounting world. Whether you’re self-employed or trying to manage your own small business, Quickbooks has a service level and a range of features that could suit you.

Meanwhile, if data security is your biggest priority, Quickbooks has you covered. In fact, the folks over at Quickbooks pride themselves on their state-of-the-art security measures

“Intuit’s professional staff and automated tools monitor service and security performance for problems 24 hours a day, 7 days a week. We rely on advanced, industry-recognized security safeguards to keep your financial data private and protected. With password-protected login, multi-factor authentication, firewall-protected servers and state of the art encryption technology for data at rest and in transit, we have the security in place to give you peace of mind.”

What features does it offer you?

-

Quickbooks’ invoice feature lets you create custom invoices, down to adding your company logo and customising the colours, and as it’s available on iOS and Android, you’ll be able to handle all your invoices on the go, hassle-free. Before you finalise an invoice you can check out a preview of what it will look like when the client views it.

Don’t need to add GST to all your invoices? Quickbooks will retain the information that you added to previous invoices, and add or omit GST as needed. And just like with Xero, you can set up repeat invoices so you won’t have to recreate them every time for your regular clients.

-

Managing your BAS (Business Activity Statement) is really simple in Quickbooks. It will keep track of what you owe and when it’s due and will automatically create a BAS summary for you.

If you aren’t entirely comfortable with handling your tax administration by yourself, you can simply enter your information and Quickbooks will help you find an accounting expert near you.

-

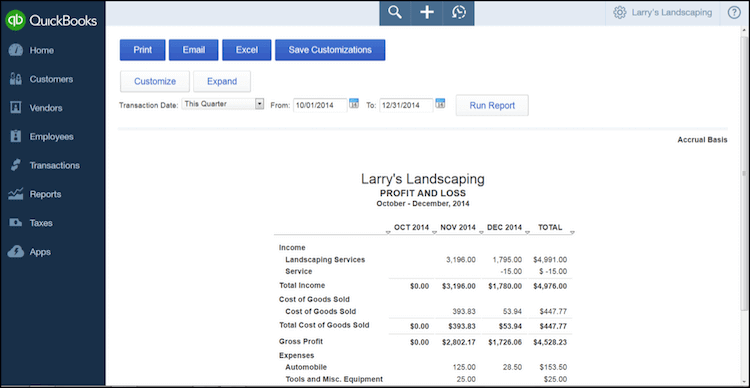

One of the most important tools you’ll need as a business owner is a profit and loss statement. This is one of your core financial statements, giving you an important snapshot of your profitability. Lucky for you, Quickbooks has a template for the statement, so you can create yours in just a few clicks.

-

When it comes to your payroll, don’t worry about all that complex administration - Quickbooks will do it all for you. With the Single Touch Payroll reporting feature, employee payroll information will be reported every time they get paid Instead of all at once at the end of the financial year – saving you time, stress and paperwork at the year end (and let’s face it, year end is way too stressful already).

Here’s a quick overview of all the payroll features on offer – find out more at QuickBooks Payroll.

How easy will you find it to use?

With Quickbooks mobile you can create a profile for your business, set up your product and services, and add all your business contacts in one place. You will have access to your expenses, reports, invoicing, and banking, all from the comfort of your phone.

Quickbooks is partnered with PayPal and Square electronic payment systems, which means you can take payments easily and get your money faster (and who doesn’t want their money available faster?)

Reporting is integrated too – if you use PayPal, you will be able to import up to 18 months’ transactions, and easily record the data in Quickbooks. Quickbooks will also update your PayPal receipts and categorise them and your expenses in Quickbooks online. Which all makes life very easy.

Like Xero, you can integrate Quickbooks with a lot of other apps, although Quickbooks only claims to be compatible with 500+, compared to Xero’s 700+. Who’s counting?

How much will it cost you?

Quickbooks does come in cheaper than Xero, but it doesn’t offer quite as extensive a list of features.

Again, there are three service levels to choose from, ‘Simple start’, ‘Essentials’ and ‘Plus’, each on a monthly subscription plan.

There’s also a simple, low-cost ‘Lite’ option if you’re self-employed and just need the very basics.

You can access the standard payroll feature for free if you have less than 10 employees, or get all the advanced payroll features for an additional $6 a month.

Still not the package you are looking for?

Then you might want to check out our third candidate, Sage – one of the most popular accounting software packages for small business owners in Australia.

Sage

The basics

Sage is geared towards start-ups and small- to medium-sized businesses. The company boasts that their package is “Simpler than a spreadsheet and easier to understand than complex accounting software.”

Sage does offer a huge number of excellent features that would be a great help for any business, from small to large, but there is a downfall – many of the features are sold in different products, which means you won’t be paying for just one service.

What features does it offer you?

-

Sage Business Cloud

Sage Business Cloud lets you bring together different products and services to manage your accounting, financials, operations, people and payroll under a single, cloud-based platform.

You can easily handle your accounting across multiple markets and locations with Sage’s multi-language, multi-currency and multi-company capabilities. You’ll also have access to a flexible general ledger, accurate invoicing, detailed budgets and planning, expense management, and so much more, all with both mobile and online access.

-

Sage Business Cloud Accounting

Sage Business Cloud Accounting (formerly Sage One) is an intuitive package for small businesses with easy on-the-go invoicing, reporting and bank integration. Like both Xero and Quickbooks, you can give your accountant access and they can handle your tax preparations for you if you don’t feel comfortable doing your tax returns and BAS yourself.

-

Sage MicrOpay

You’ll find it super easy to manage your payroll with the third-party Sage MicrOpay system – you can also use it to manage your employee benefits and compensation with ease. MicrOpay is designed with medium-sized businesses in mind, and gives you a suite of functions to handle your payroll and HR.

-

Sage WageEasy

Sage WageEasy Payroll and HR on the other hand, is geared more towards small businesses, offering you “simple and efficient payroll processing while ensuring compliance with modern awards and legislation”. Like Quickbooks, WageEasy uses Single Touch Payroll to simplify your reporting on employee tax and super.

-

Sage ESS

Sage ESS payroll and HR is a cloud-based self-service tool you can offer to your employees, giving them (and you) any-time any-where access to their pay and benefits data.

How easy will you find it to use?

Like Xero and QuickBooks, you can integrate Sage with PayPal – but it doesn’t yet integrate with Stripe or Square payment solutions.

You may find Sage more complex to set up than Quickbooks or Xero, as there are so many different products and features to choose from, install and integrate with your existing systems. Having said that, it does mean you can pick and choose the products and services you want, so you won’t be clogging up your systems with features and services you don’t need.

What’s more, Sage offer comprehensive support for all of their products, so if you have any problems getting them to sync together – or any other issues with using their services – they’ll be on hand to help you out.

They also offer software training and webinars to help you learn how to best use their features.

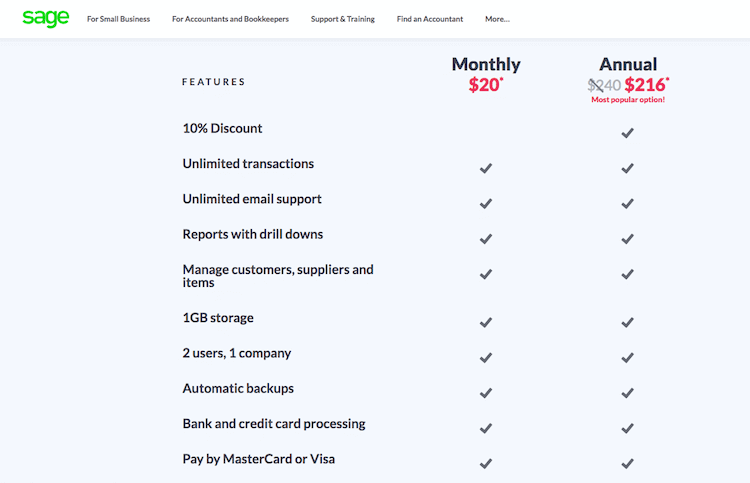

How much will it cost you?

This is trickier to answer than for Quickbooks or Xero, because each Sage product has its own price point.

Sage Business Cloud Accounting comes in at $20 a month (with a 35-day free trial) – but for the other products you’ll need to request a demo and a tailored price quote.

Business accounting software compared

| Xero | Quickbooks | Sage | |

|---|---|---|---|

| Features | 700+ app integrations, auto-invoicing, billing and expenses tracking, set currencies, payroll system | 500+ app integrations, auto-invoicing, financial statements, payroll system | Business cloud accounting and financials, cloud-based payroll & HR system |

| Bank Integration | Yes | Yes | Yes |

| Business Activity Statement (BAS) Features | BAS reporting, lodge BAS directly | BAS reporting, lodge BAS directly | BAS reporting |

| Payroll | $25 plan = 1 person $50 plan = 2 person $65 plan = 5 person Extra plans available for 10+ people |

First 10 staff included, then $4-$6 per person per month | Up to 5 staff included, then $4-$6 per person per month |

| Price | $25 - $65 monthly | $10 - $35 monthly | $20 monthly or $216 annually |

| Usability | User-friendly, mobile compatible | User-friendly, mobile compatible | User-friendly, mobile compatible |

| Support | 24/7 | 24/7 | 24/7, software training and webinar |

Conclusion

Xero, Quickbooks and Sage all have a great range of features to help you manage your accounting and payroll functions (and a lot more besides) and they’re popular with Australian business owners for very good reason.

It may sound like a cop-out, but the truth is that which package is best for you really does depend on your business – how big you are, how many markets / currencies you need to operate in, and how many of your business functions you’re hoping to automate.

Your first source of info for any of these products should be the customer support reps. They’ll be able to give you much more detail about all the different features, and answer any concerns you have about how the software will work with your specific systems.

Give them a call and don’t be afraid to ask a lot of questions!

Nothing beats word-of-mouth, of course, so once you’ve chatted to the reps, get in touch with the people in your network and ask their opinion.

After all, there really is no better way to get honest, ‘what the reps won’t tell you’ feedback about the product and service than asking someone who has been through the installation and integration process first-hand and uses the software day-to-day.

If you’re still not sure, give one (or more) of the free trials a whirl, and see for yourself if it lives up to the hype.

Have you tried any of these packages – or would you recommend a totally different accounting software package?

Do let us know in the comments below.